- YOU NEED A BUDGET COST UPGRADE

- YOU NEED A BUDGET COST SOFTWARE

- YOU NEED A BUDGET COST TRIAL

- YOU NEED A BUDGET COST PLUS

Try to include due dates for individual bills. Exact figures or averages are ideal, but estimates are better than nothing.

Make a detailed list of all your monthly expenses, big and small, across all budget categories. Per YNAB’s Getting Started Guide, preparing to set up your account takes about 20 uninterrupted minutes and includes three steps:

Getting started with the YNAB budgeting app is pretty easy too.

YOU NEED A BUDGET COST PLUS

More than 100 educational workshops, plus a full-length book, complement robust desktop and mobile money management apps for individual and joint budgets. Unlike competing “set it and forget it” products that rely on extensive automation and don’t do much to teach their users about building sustainable budgets, YNAB is as much an educational resource as a practical one.

YOU NEED A BUDGET COST TRIAL

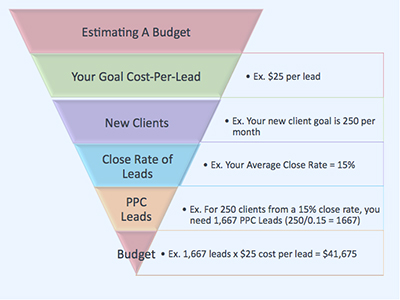

In addition to the free trial period, student users enjoy this budgeting app free for 12 months.Īll things considered, this is a small price to pay for a steady hand on the financial till. Annual plan users pay $84 per year - a $59 savings - and can also cancel at any time. Monthly plan users pay $11.99 per month after a 34-day free trial period and can cancel at any time. YNAB: The BasicsĪfter a generous risk-free trial period, YNAB does require a paid subscription. Using the popular and reliable zero-based budgeting method and four simple rules for effective budgeting, YNAB empowers users to take control of their finances and keep more of their money where it belongs: in their pockets.

YOU NEED A BUDGET COST SOFTWARE

Of these popular budgeting software programs, You Need a Budget (YNAB) is one of the very best.

YOU NEED A BUDGET COST UPGRADE

All represent an upgrade from old-school spreadsheets, which are time-consuming and tedious to maintain. More than a dozen legitimate alternatives to Mint offer a variety of takes on the budgeting process. While it’s not an accounting package per se, it certainly has value depending, of course, on whether you want to pay for the privilege of using it.If you’re in the market for a new budgeting tool, you have no shortage of choices. We’re also pleased to see the ability for US, along with Canadian users to be able to import data from their banks. You Need a Budget’s creators seek to underline its high-grade encryption methods that protect your sensitive financial information once you’ve added it to their servers, as you would expect. Indeed, there are aspects of the app edition that make it rather more preferable to the desktop model. We are particularly smitten with the app version of the service, which gives you freedom of use no matter where you might be and emulates the desktop edition perfectly.

Overall this is a solid cloud-based software solution that should help you get on top of your finances. You Need a Budget continues to improve with each successive release. All in all then we’d like to see this beefed up in future iterations. While email support is okay, it’s not quite the same, although another alternative is to consult the forums.Īgain though you're not always guaranteed the information you get is going to be 100% reliable. There is a step-by-step guide and FAQs, which should answer many of your queries, but it would always be a bonus to be able to contact a real person for those more unusual requests. There’s no phone support, which considering this is a paid-for service leaves You Need a Budget sorely lacking. This is even more of a point when you consider the ongoing subscription charge for using the service. The area of support has to currently be one of You Need a Budget’s weakest areas and could do with some improvement. The lack of real people support is something of a negative however (Image credit: You Need a Budget) Support

0 kommentar(er)

0 kommentar(er)